Owning and managing rental property is a business activity. Landlording can be a full or part time gig. Whether you create a separate business for it or not, landlord record keeping for rental property is important for tax purposes. The two main types of records are the income and expenses and the supporting documentation of the income and expenses.

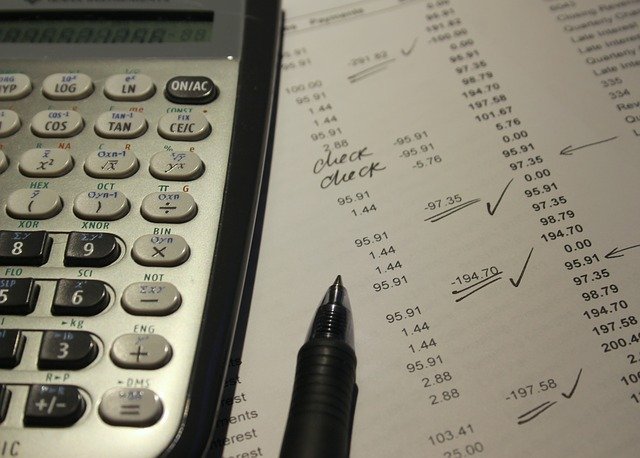

Income & Expense Records

Landlord record keeping for rental property makes it easier to complete tax forms, such as Form 1040 Schedule E. The tax forms determine if you made a profit or had a loss for that year from your rental property. Schedule E organizes activity by each property, so you’ll want to keep income and expense records for each rental address.

Supporting Documentation for Landlord Record Keeping for Rental Property

Proof of income and expenses is especially important if you are audited. Receipts and cancelled checks prove the income earned and expenses incurred in case the IRS has questions. Supporting documents leave a paper trail and prove that your claims are correct. They also show the tax deductions you receive are legitimate.

Worth It

Landlords with good recordkeeping habits will maximize the tax benefits of owning and managing rental property. Keeping track of income and expenses and maintaining supporting documentation will reduce the stress if audited and provide peace of mind. RentalIncomeExpense.com is a free and complete solution for landlords. Try it today!